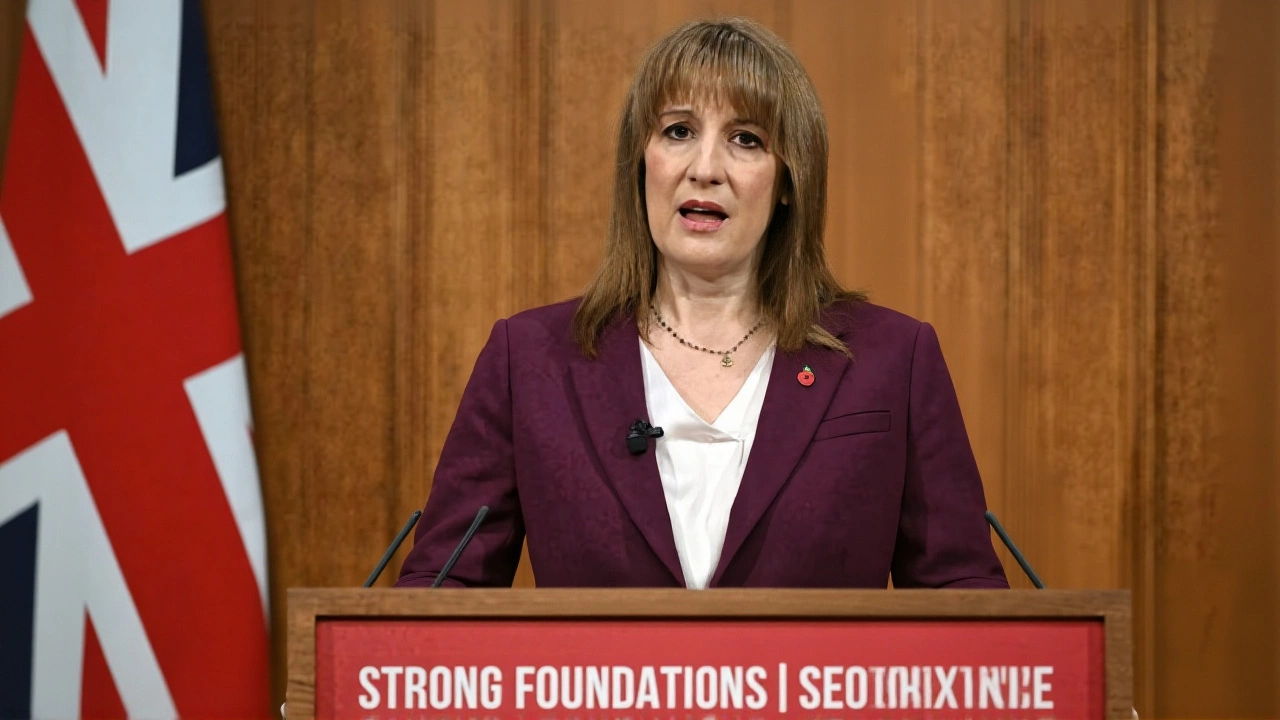

When Rachel Reeves stood before Parliament on Wednesday, November 26, 2025, to deliver the Autumn Budget 2025, she didn’t just announce tax changes—she handed drivers a temporary reprieve with one hand and took it back with the other. The Office of Budget Responsibility (OBR) confirmed the UK government would extend the 5p-per-litre fuel duty cut for five more months, keeping it in place until the end of August 2026, with a full reversal set to begin in April 2027. The move, while welcomed by motorists, comes with a £2.4 billion price tag for the Treasury in the 2026-27 fiscal year—and a longer-term cost of £120 billion since 2010, thanks to 16 consecutive years of freezes and cuts.

Why This Freeze Feels Like a Trap

Drivers across Britain will see petrol prices stay low through the winter, thanks to the extension. The Department for the Treasury claims the average driver will save £89 this year thanks to the cut and the new Fuel Finder scheme, launching in early 2026. That’s a digital tool requiring all UK petrol stations to report real-time prices, letting consumers find the cheapest fuel within a 10-mile radius. Sounds smart. But here’s the thing: the relief is engineered to end.

After September 2026, the 5p cut will vanish—not all at once, but in slow, predictable increments tied to the Retail Prices Index (RPI). By March 2027, fuel duty will return to March 2022 levels, just before Russia’s invasion sent oil prices soaring. Simon Williams, head of policy at the RAC, put it bluntly: "Drivers will be relieved... but this relief will be very short-lived." He added that without the cut, most drivers are still paying more per litre than they did before February 2022. The temporary fix didn’t undo the inflation shock—it just masked it.

The Hidden Cost: Who Really Benefits?

The Social Market Foundation thinktank dug into the numbers and found something uncomfortable: the longest-running fuel duty freezes have disproportionately helped the wealthy. A Ford Focus driven 10,000 miles a year saves £120 annually from the 5p cut. A Range Rover driven 25,000 miles? That’s £300. And for those with multiple cars or long commutes, the savings compound. Meanwhile, low-income households, often reliant on older, less efficient vehicles, see little benefit from lower fuel prices if their wages haven’t risen. The OBR estimates these freezes have added 120 million tonnes of CO₂ to the atmosphere since 2010—equivalent to the annual emissions of 25 million cars.

It’s not just environmental. It’s economic. By keeping fuel artificially cheap, the government discouraged investment in public transport and electric vehicles. Now, they’re trying to correct course—with a twist.

Electric Vehicles: Incentives and New Taxes

Just as the UK pushes toward net zero, the government is introducing a mileage-based charge for electric and plug-in hybrid vehicles starting in 2028. The idea? Replace lost fuel duty revenue as more people ditch petrol. The RAC warned this could slow EV adoption. So, to soften the blow, the government expanded the Electric Car Grant, now covering more models and extending eligibility to lower-income buyers. It’s a classic political balancing act: punish EV drivers later, but reward them now.

Meanwhile, rail fares are frozen for the first time in 30 years. Commuters on annual season tickets could save up to £400. Pensioners get an extra £575 a year thanks to the triple lock. And the two-child benefit cap? Gone. That’s £11 billion in new spending.

The Tax Surge: £26 Billion in New Revenue

But the budget isn’t all handouts. Rachel Reeves unveiled £26 billion in tax increases. The most controversial? Extending the freeze on income tax thresholds until 2031. That means millions will be pushed into higher tax bands as wages rise with inflation—what economists call "fiscal drag." Reeves previously called this policy "hurtful to working people." Now, the OBR estimates it will raise £8 billion by 2029-30.

Also new: a "mansion tax" on homes valued over £2 million, and the end of national insurance exemptions for salary-sacrificed pension contributions above £2,000 annually. The goal? Raise revenue without raising headline rates. It’s stealth taxation—effective, but politically risky.

What’s Next? The Clock Is Ticking

By April 2027, the fuel duty reversal will begin. Expect pump prices to creep up by 1.5% to 2% annually, tied to RPI. The Department for Transport will monitor public reaction closely. If backlash grows, they may delay the full return to 2022 levels. But the OBR’s fiscal headroom—now over £21.7 billion—gives Reeves breathing room. She’s betting that by 2027, voters will have forgotten the 5p cut, and the real issue will be whether the UK can afford to keep its public services running.

Behind the Numbers: The Bigger Picture

What’s striking isn’t just the scale of the fuel duty cuts—it’s how long they’ve lasted. Since 2010, no Chancellor has dared raise fuel duty in line with inflation. It became political suicide. But now, the cost is unsustainable. The Treasury is borrowing less than any G7 country, growth is up to 1.5% in 2025, and inflation is projected to hit 0.4% in 2026. Reeves has room to maneuver. But she’s also setting up a collision course: between fiscal responsibility and voter expectations.

The Fuel Finder is clever. The pension boost is popular. The EV charge is necessary. But the fuel duty reversal? That’s the test. Will drivers accept higher prices after years of low fuel costs? Or will this become the next fuel protest movement?

Frequently Asked Questions

How much will my fuel bill increase after September 2026?

After September 2026, fuel duty will rise in line with the Retail Prices Index (RPI), not inflation. If RPI averages 2.5% annually from 2027, a typical 50-litre tank that currently costs £65 could rise to £70 by early 2028. The 5p cut will disappear gradually, not all at once, meaning increases will be small but persistent—about 1.5p to 2p per litre over 12 months.

Who benefits most from the fuel duty freeze?

The wealthiest benefit most. Households driving over 15,000 miles a year, often with multiple vehicles or luxury cars, save hundreds more than low-income drivers who use older, less efficient models. The Social Market Foundation found the top 20% of earners captured 40% of the total savings from the 5p cut, while the bottom 20% saw less than 10%.

Why is the government taxing electric vehicles now?

Electric vehicles pay no fuel duty, so as their numbers grow, the Treasury loses billions in revenue. The 2028 mileage charge is designed to replace that lost income. The government is expanding the Electric Car Grant to soften the blow, but the move signals a shift: EVs won’t be permanently tax-free. It’s about fairness and sustainability.

Will the Fuel Finder scheme actually save me money?

Yes—if you’re willing to drive a little further. The scheme requires all petrol stations to report prices, so apps will show you the cheapest fuel within a 10-mile radius. Early trials in London and Manchester showed drivers saved 5p to 8p per litre by switching stations. For someone filling up weekly, that’s £15 to £25 a month. But it won’t help those in rural areas with limited options.

What’s the impact on the environment?

The 16-year fuel duty freeze has added an estimated 120 million tonnes of CO₂ to the atmosphere since 2010—equivalent to the annual emissions of 25 million cars. Lower fuel prices encourage more driving, especially for non-essential trips. The government admits this but argues the staggered reversal and EV incentives will help offset emissions growth by 2030.

Why did Rachel Reeves reverse her stance on tax thresholds?

The OBR projected a £8 billion revenue gap by 2029-30 if thresholds remained frozen. Reeves, who previously called the freeze "hurtful," now says it’s necessary to fund pensions, rail freezes, and the scrapping of the two-child benefit cap. It’s a trade-off: short-term pain for working families to avoid deeper cuts to public services later.